The Dark Side Of Mortgage REITs. Jussi Askola is a former private equity real estate investor with experience working for a 250 million investment firm in Dallas Texas.

Urgent Warning To Reit Investors Seeking Alpha

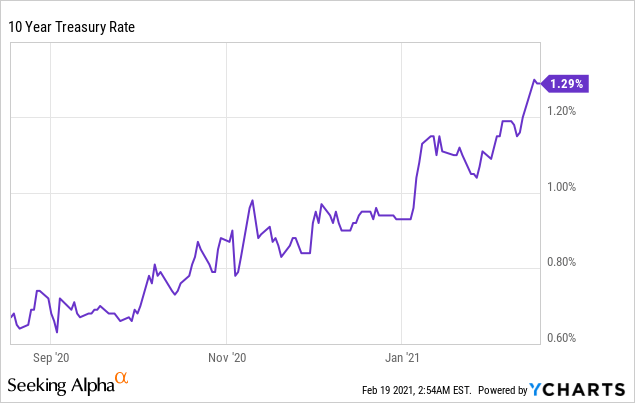

As the Federal Reserve has sought to drive down long-term interest rates via quantitative easing the interest rate spread that these funds rely on to make money has contracted.

Why are mortgage reits getting killed. The mortgage Reits fund themselves by pledging. Mortgage Reits own roughly 500bn in mortgage-backed bonds or about 5 per cent of the market according to Nomura.

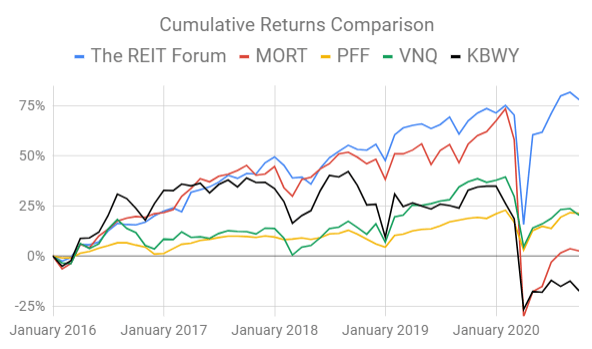

Great News For Reits Start Buying Discounted Reits To Piggyback The Recovery Story Seeking Alpha

Posted Withrepost Buytheblock While Real Estate Investing Certainly Isnt For Everyone It Can Be Ve Real Estate Investing Investing Getting Into Real Estate

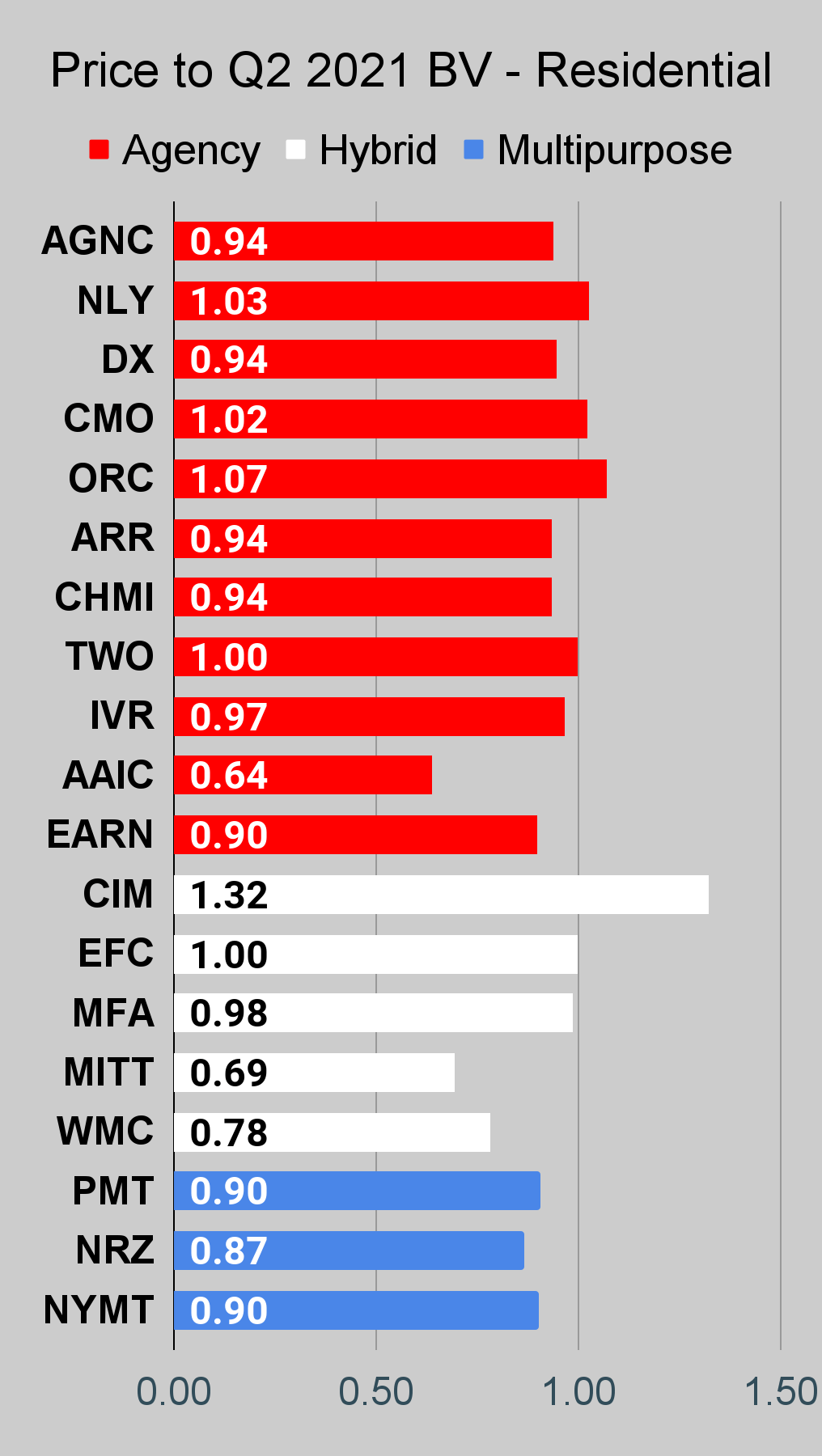

The Flash Sale On Mortgage Reits Seeking Alpha

Mortgage Reits Hit By Uncertainty Wsj

The Flash Sale On Mortgage Reits Seeking Alpha

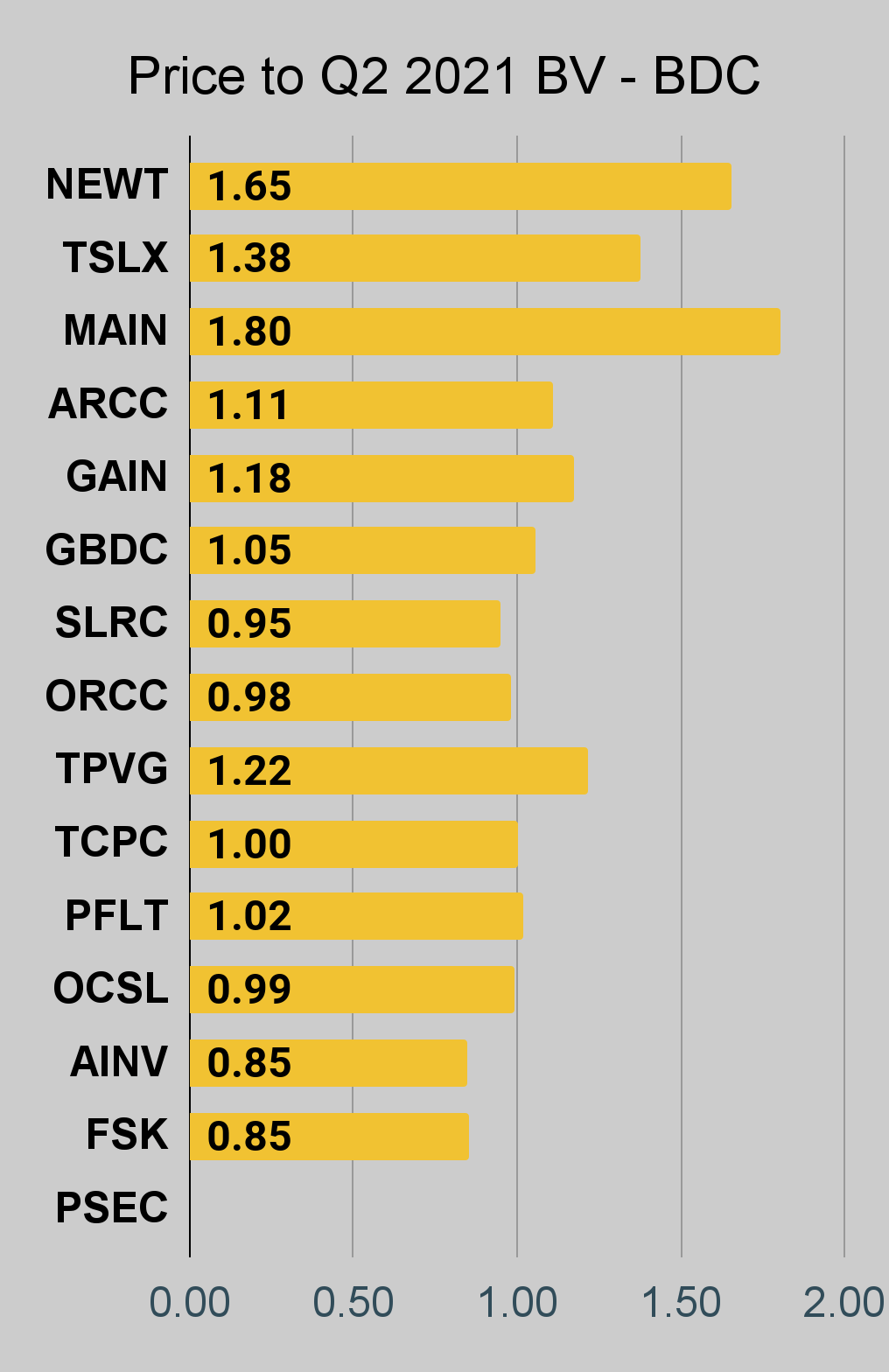

2 Mortgage Reits Fat 8 To 10 Dividend Yields With Upside Seeking Alpha

2 Mortgage Reits Fat 8 To 10 Dividend Yields With Upside Seeking Alpha

Mortgage Reits To Sell Seeking Alpha

Mortgage Reits Down But Not Out Nasdaq